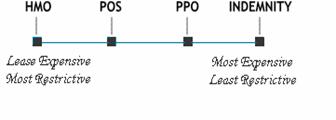

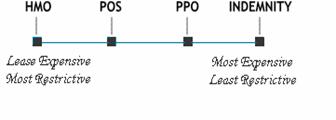

Managed Care Introduction -- Managed Care Types -- Advantages and Disadvantages -- How to Choose the Right Plan

Challenges Concerning Medical Benefits -- Relationships to Employee Benefit Wheel -- Web Links Page -- Works Cited

Advantages and Disadvantages

Many people

enjoy having an HMO as health insurance because the plan does not require claim

forms to see a doctor or during hospital stays. The HMO member only has to

present a card that states proof of insurance at the doctor's office or

hospital. In an HMO the members may have to wait longer for an appointment than

with an indemnity insurance plan. The HMO charges a fixed monthly fee so its

members can receive health care. There will be a small co-payment for each

doctor visit; however with the HMO, fees can be forecasted unlike a

fee-for-service insurance plan. Although freedom of choice is given up,

out-of-pocket expenses are very low. In an HMO there are some disadvantages.

The premium that is paid is just enough to cover the costs of doctors in the

network. The members are “stuck” to a primary care physician and if managed

care plans change, then the member may not be able to continue with the same

PCP. On major disadvantage is that it is difficult to get any specialized care

because the members must get a referral first. Any kind of care that is sought

that is not a referral or an emergency is not covered. The HMO plan is one of

the fastest growing types of managed care in terms of expenses, while being the

most restrictive type of health care.

Advantages and disadvantages of PPO insurance

As a member of a PPO, health care costs are low when the member stays within the provided network. This plan allows more freedom than an HMO in many ways. The member is not required to choose a primary care physician and can see a specialist without a referral, including the specialists that are outside the network. If care is sought outside the network the costs are more expensive and all of the paperwork can be the individual’s responsibility. This plan offers a large network to choose from and an array of doctors. Co-payments will be more expensive than other types of managed care due to the cost of extra amenities provided. PPOs are less expensive than a fee-for-service type. There are no deductibles in most plans; however, in some cases the member may need to pay one before receiving care. The out-of-pocket costs are large and the plan is limited in some ways, such as having to stay in the main network of doctors and specialists.

A POS type of plan acts like an HMO except that it has more freedom when it comes to choosing doctors and facilities. This type of plan allow for its members to travel outside the network at a higher deductible. The plan uses preventive care, as it is more cost effective in the long run. The member has to pay a small amount of co-insurance, if any at all. Regular office visits require small co-pays. If the member wants to travel outside the network it must first meet the deductible requirement and then pay a percentage of the expenses. The premiums are more expensive than an HMO but allow more freedom.

An MSA plan is good for a small business because the premiums are more affordable. Instead of having a policy with high premiums and low co-pays the MSA offers a high deductible in case of an emergency or a major medical expense. The member has complete control over doctor and facility selection. The MSA plan requires the member to make regular deposits into a medical savings account to cover minor expenses. The member has to be able to afford the bill before meeting the requirements for the deductible. All deductibles must be paid to in order to receive any kind of medical care. A disadvantage for large businesses is that this type of plan is not available. Deposits made toward the medical savings plan are one hundred percent tax-deductible, and can be used towards any out of pocket medical expenses. For example, deductibles and regular office visits would be paid using the MSA. This allows you to pay for healthcare expenses with pretax dollars, a great advantage. All of the money that is not used for medical expenses will stay in the account until needed. This plan is one of the most expensive plans giving the least amount of restrictions. Here is a link to a company that offers an MSA: www.msabank.com.