Womenís Participation in Retirement Plans

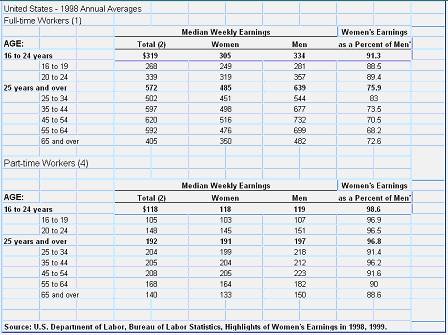

On

average women earn less than men, it is estimated they earn 73 cents to every

dollar a man earns. This can be due to them leaving and re-enter the workforce

because of family obligations. Also the life expectancy of women is greater

than men so this makes it essential for them to have a retirement plan. The

chart below shows the earnings gaps between men and woman.

Presently

the median earnings of full-time women workers in 2001 were $30,420, compared

to $40,136 for men. Women's earnings in relation to menís have increased from

60 percent of men's earnings in the 1960s to 76 percent in 2001.

The

graph below illustrates the life expectancy rate of men and women in different

countries.

The

most widely used retirement program by women is Social Security. Women

represent 58 percent of all Social Security beneficiaries age 62 and older and

approximately 71 percent of all beneficiaries age 85 and older. Social Security

is a federal program in which women pay into through their employment. It is

also progressive in that lower-wage earners receive a higher percentage benefit

than higher-wage earners do. The system returns a greater percentage of

pre-retirement earnings to a lower-wage worker than to a higher-wage worker.

Women who are low-wage workers receive back more benefits in relation to past

earnings than do high-wage earners. They may also receive benefits as a spouse

or ex-wife given they were married for ten years. They can also choose to

receive their own Social Security benefits or they can choose to receive it as

a spouse but canít collect both at the same time. Age 65 is the current age at

which you qualify to receive full Social Security benefits. Also you can

receive reduced benefits if you are age 62 and you want to retire early, age 62

and divorced and were married ten years or more your ex-husband is qualified

for retirement benefits, age 60 if your husband or ex-husband has died, and at

age 50 if you are a disabled widow. The benefits they receive are for their

rest of their lives from start of their eligibility. Typically if a worker has

ten years of paying into the Social Security they will receive some benefits.

There is also a program under Social Security called SSI, which stands for

Supplemental Security Income. It pays a monthly benefit to people over age 65

who have a small income or younger persons who are disabled and poor.

Another

concern for women is that elderly women are less likely than elderly men to

have significant income from pensions other than Social Security. Due to this,

by the end of 2002, a womenís average monthly retirement benefit averaged $774,

while menís benefits averaged $1,008. In 2000 there was only 18 percent of

women aged 65 or older were receiving their own pensions (either as a retired

worker or widow), compared to the 31 percent of men. But, in recent years,

there seems to be a change in this situation.†

Pension coverage is increasing for women in today's workforce. In 2001,

47 percent of all participants in a pension plan were women and 53 percent were

men. The only down side to this is that women generally receive lower pension

benefits, compared to men, due to their relatively lower earnings. Given the

present condition of Social Security, it is wise not just for women but also

men to have an alternative retirement plan.

Since

it is expected that Social Security will become insolvent, women and men should

both look into other retirement plans. Some other sources for retirement come

from pension plans, which include defined contribution plans and defined

benefit plan. There are many types of pension plans and it is up to worker to

find out more information about it such as if they are included in it or how

many years you must have vested.

When it

comes to your retirement its not enough to rely on one or two sources for your

financial needs. Another really important way to prepare for retirement is to

save and invest. A basic plan is to figure how your spending your income now,

making a plan to save a portion of your income every month, reduce your credit

card debt, and participating in your companies pension plan.