|

ASSIGNMENT 2: CSUS

MORTGAGE Ver 2.0 top Solution: CSUSMortgageV2.zip

The purpose of this assignment is to provide you with a

comprehensive exercise to practice the following material (Chapters 4, 5, 7,

and 8):

-

Making

decisions

-

Validating

input

-

Writing

event procedures

-

Creating

Menus

-

Writing

functions

-

Using

loops

-

Using

arrays

Interface Description:

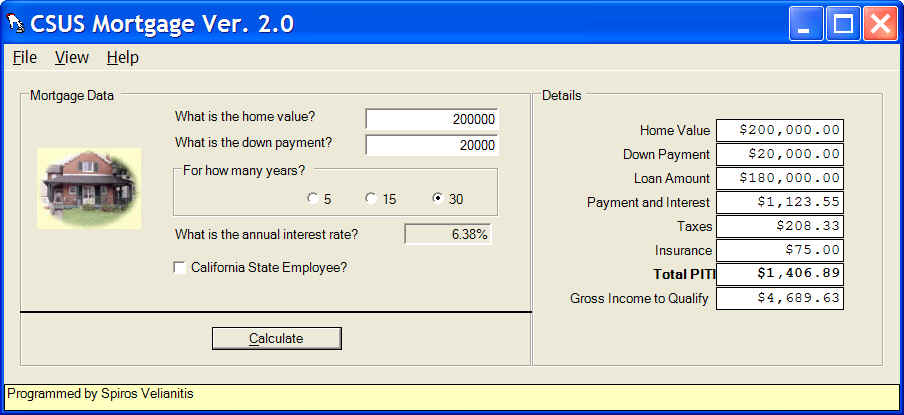

Figure 2.1

-

Create the interface shown in Figure 2.1

-

Menu hierarchy has the following menus: File/Exit,

View/Amortization, View/Clear, Help/About. A separator used used between

View/Amortization and View/Clear.

-

In the details group box, all components are labels with

Courier New font.

-

The annual interest rate text box is disabled (cannot

change content).

-

Calculate button is disabled.

Implementation Description:

Class

Diagram Class

Diagram

- Create methods shown in the class diagram above:

- When home value and down payment text boxes are filled and are

numeric, the calculate button is enabled. Also, the findInterestRate

method is called to find and display the interest rate from the interest

rate table. Show appropriate error messages if not numeric data is typed

and disable the calculate button.

- Interest rate is calculated based on the following table (must create

an array of arrays to search the table for the appropriate interest

rate):

| Amount is |

But not over |

5 year rate |

15 year rate |

30 year rate |

| 0 |

100,000 |

0.0475 |

0.0525 |

0.065 |

| 100,000 |

250,000 |

0.045 |

0.05 |

0.0638 |

| 250,000 |

1,000,000 |

0.04125 |

0.04575 |

0.0625 |

| 1,000,000 |

|

0.0375 |

0.0425 |

0.06125 |

- Interest rate is discounted by 0.001 for state employees.

- When radio buttons or the employee check box is clicked, the new

interest rate is automatically found and displayed.

- The calculate button calculates and displays all detail labels

(monthly amounts).

- Loan amount is Home value - Down payment

- Payment and interest is the same calculation as assignment 1 (pmt

function).

- Taxes is 1.25% per year of the home value.

- Insurance is charged only when the down payment is less than 20%

of the home value. Insurance is 0.005 of the loan amount per year.

- PITI is the sum of Payment, Interest, Taxes, and Insurance.

- Gross Income to qualify is PITI/0.3

- File/Exit exits application.

- View/Clear sets the form to its initial state.

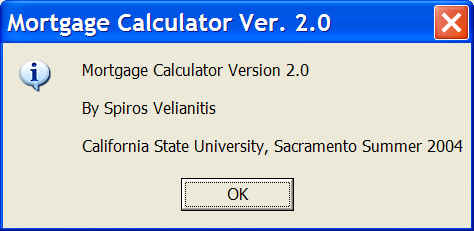

- Help/About shows the following message box:

Figure 2.2 Figure 2.2

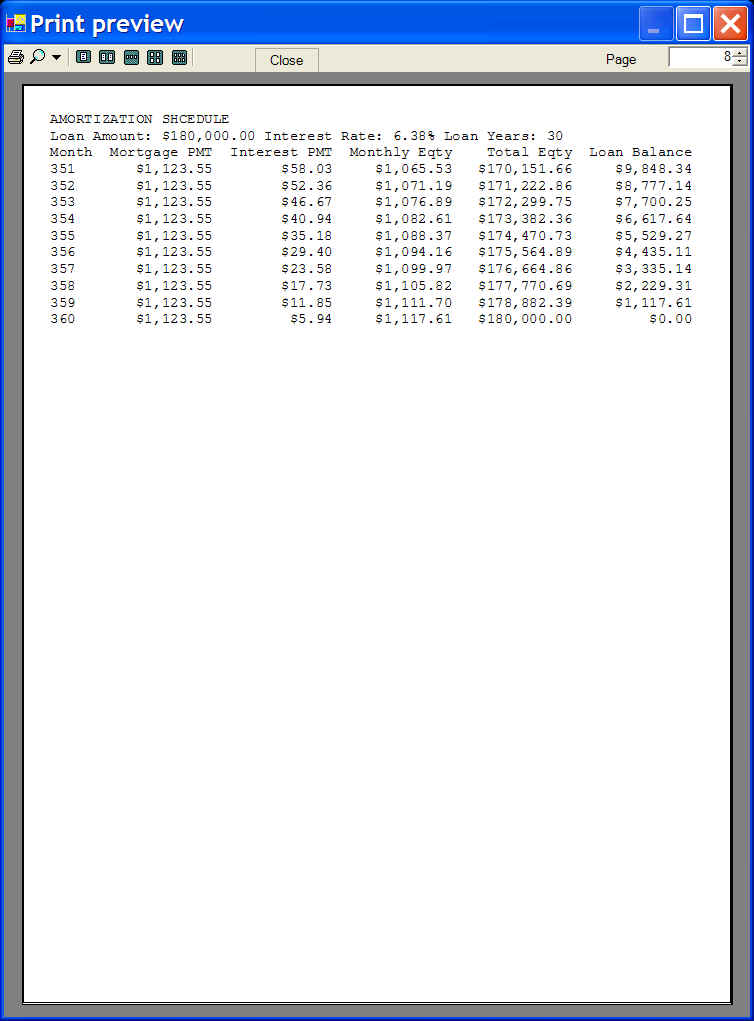

- View/Amortization shows the Amortization report similar to the one

shown in Figure 2.3 (only last page of the report is shown). To print

the report:

Figure 2.3 Figure 2.3

-

Go to a loop for the number of months defined by the

Loan Years variable. Inside the loop the logic for the data in each of

the columns is the following:

-

Month: Is a serial number that starts from 1 and

ends with the number of months in the Loan Years (Loan Years times

12)

-

Mortgage PMT: A constant payment for the entire loan

period (calculated by the pmt function)

-

Interest PMT: The interest expense for each month

(calculated by the ipmt function) using the loan balance

-

Monthly Equity: The equity gains for this month; is

the difference between Mortgage PMT and Interest PMT

-

Total Equity: The accumulated equity (sum of

previous Equities)

-

Loan Balance: Loan balance - Monthly Equity

-

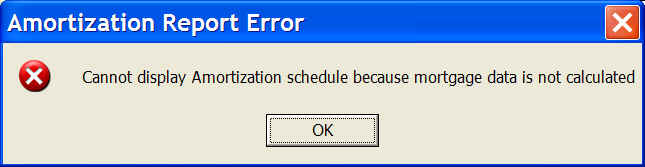

If the calculate button has not been pressed and there

is no PITI in label, the following message will be displayed:

Figure 2.4 Figure 2.4

- formatMonthColumn function receives a month and returns a string with

the month right-padded with spaces till the string becomes 5 characters

long.

- formatCurrencyColumn function receives a double amount and returns a

string with the amount formatted as currency with spaces left-padded

till the string becomes 14 characters long. If the formatted number does

not fit in the 14 characters column size, the overflow symbol

(##############) is displayed.

- Both functions above are used to align the columns for the report.

- Report is printed in Courier New font size 12.

- First 3 lines are printed in all pages of the report.

|