CALIFORNIA STATE UNIVERSITY, SACRAMENTO

Department of Economics

Economics 135

Prof. Yang

ANSWERS TO END-OF-CHAPTER PROBLEMS WITHOUT ASTERISKS

Chapter 1 2 3 4 5 6 7 8 9 10 11 12 15 16 17 18 19 22

WHY STUDY MONEY, BANKING, AND FINANCIAL MARKETS?

7. The basic activity of banks is to accept deposits and make loans.

9. The interest rate on three-month Treasury bills fluctuates more than the other interest rates and is lower on average. The interest rate on Baa corporate bonds is higher on average than the other interest rates.

11. Higher stock prices means that consumers' wealth is higher and so they will be more likely to increase their spending.

13. It makes British goods more expensive relative to American goods. Thus American businesses will find it easier to sell their goods in the United States and abroad and the demand for their products will rise.

15. When the dollar increases in value, foreign goods become less expensive relative to American goods; thus you are more likely to buy French-made jeans than American-made jeans. The resulting drop in demand for American-made jeans because of the strong dollar hurts American jeans manufacturers. On the other hand, the American company that imports jeans into the United States now finds that the demand for its product has risen, so it is better off when the dollar is strong.

AN OVERVIEW OF THE FINANCIAL SYSTEM

2. Yes, I should take out the loan, because I will be better off as a result of doing so. My interest payment will be $4,500 (90% of $5,000), but as a result, I will earn an additional $10,000, so I will be ahead of the game by $5,500. Since Larry's loan-sharking business can make some people better off, as in this example, loan sharking may have social benefits. (One argument against legalizing loan sharking, however, is that it is frequently a violent activity.)

4. The principal debt instruments used were foreign bonds which were sold in Britain and denominated in pounds. The British gained because they were able to earn higher interest rates as a result of lending to Americans, while the Americans gained because they now had access to capital to start up profitable businesses such as railroads.

6. You would rather hold bonds, because bondholders are paid off before equity holders, who are the residual claimants.

10. They might not work hard enough while you are not looking or may steal or commit fraud.

12. True. If there are no information or transactions costs, people could make loans to each other at no cost and would thus have no need for financial intermediaries.

14. A ranking from most liquid to least liquid is (a), (b), (c), and (d). The ranking is similar for the most safe to the least safe.

Chapter 3

WHAT IS MONEY?

1. (b)

3. Cavemen did not need money. In their primitive economy, they did not specialize in producing one type of good and they had little need to trade with other cavemen.

5. Wine is more difficult to transport than gold and is also more perishable. Gold is thus a better store of value than wine and also leads to lower transactions cost. It is therefore a better candidate for use as money.

7. Not necessarily. Checks have the advantage in that they provide you with receipts, are easier to keep track of, and may make it harder for someone to steal money out of your account. These advantages of checks may explain why the movement toward a checkless society has been very gradual.

8. The ranking is (a) and (c) the most liquid; then, in descending order of liquidity, (e), (f), (b), and (d).

10. Because of the rapid inflation in Brazil, the domestic currency, the real, is a poor store of value. Thus many people would rather hold dollars, which are a better store of value, and use them in their daily shopping.

14. The highest weight would be assigned to currency and NOW accounts, because they are the most liquid (have the greatest degree of "moneyness"). Savings account deposits and U.S. Savings Bonds would receive lower weight because they are somewhat less liquid, while houses and furniture would receive the lowest weights, because they are the most illiquid.

UNDERSTANDING INTEREST RATES

2. No, because the present discounted value of these payments is necessarily less than $20 million as long as the interest rate is greater than zero.

4. The yield to maturity is less than 10 percent. Only if the interest rate was less than 10 percent would the present value of the payments add up to $4,000, which is more than the $3,000 present value in the previous problem.

6. 25% = ($1,000- $800)/$800 = $200/$800= .25.

8. If the interest rate was 12 percent, the present discounted value of the payments on the government loan are necessarily less than the $1,000 loan amount because they do not start for two years. Thus the yield to maturity must be lower than 12 percent in order for the present discounted value of these payments to add up to $1,000.

10. The current yield will be a good approximation to the yield to maturity whenever the bond price is very close to par or when the maturity of the bond is over ten years.

12. You would rather be holding long-term bonds because their price would increase more than the price of the short-term bonds, giving them a higher return.

14. People are more likely to buy houses because the real interest rate when purchasing a house has fallen from 3 percent (= 5 percent - 2 percent) to 1 percent (= 10 percent - 9 percent). The real cost of financing the house is thus lower, even though mortgage rates have risen. (If the tax deductibility of interest payments is allowed for, then it becomes even more likely that people will buy houses.)

PORTFOLIO CHOICE

1. (a) Less, because your wealth has declined; (b) more, because its relative expected return has risen; (c) less, because it has become less liquid relative to bonds; (d) less, because its expected return has fallen relative to gold; (e) more, because it has become less risky relative to bonds.

3. (a) More, because it has become more liquid; (b) less, because it has become more risky; (c) more, because its expected return has risen; (d) more, because its expected return has risen relative to the expected return on long-term bonds, which has declined.

5. The rise in the value of stocks would increase people's wealth and therefore the demand for Rembrandts would rise.

7. True, because the benefits to diversification are greater for a person who cares more about reducing risk.

9. True. Since a risk-averse person will always prefer securities with low risk, a higher expected return, and high liquidity, he or she will never want to purchase a security that has a lower expected return with more risk and less liquidity than another security.

11. The beta = -3/2 = -1.5.

13. False. A higher beta means that a security has more systematic risk which cannot be diversified away and as the capital asset pricing model indicates, its risk premium will then be higher, not lower.

15. The capital asset pricing model assumes that there is only one source of systematic risk, that found in the market portfolio, while the arbitrage pricing theory takes the view that there are several sources of risk in the economy that cannot be eliminated by diversification.

THE BEHAVIOR OF INTEREST RATES

2. In the loanable funds framework, when the economy booms, the demand for bonds increases: the public's income and wealth rises while the supply of bonds also increases, because firms have more attractive investment opportunities. Both the supply and demand curves (Bd and Bs) shift to the right, but as is indicated in the text, the demand curve probably shifts less than the supply curve so the equilibrium interest rate rises. Similarly, when the economy enters a recession, both the supply and demand curves shift to the left, but the demand curve shifts less than the supply curve so that the interest rate falls. The conclusion is that interest rates rise during booms and fall during recessions: that is, interest rates are procyclical. The same answer is found with the liquidity preference framework. When the economy booms, the demand for money increases: people need more money to carry out an increased amount of transactions and also because their wealth has risen. The demand curve, Md, thus shifts to the right, raising the equilibrium interest rate. When the economy enters a recession, the demand for money falls and the demand curve shifts to the left, lowering the equilibrium interest rate. Again, interest rates are seen to be procyclical.

5. Interest rates fall. The increased volatility of gold prices makes bonds relatively less risky relative to gold and causes the demand for bonds to increase. The demand curve, Bd, shifts to the right and the equilibrium interest rate falls.

7. Interest rates might rise. The large federal deficits require the Treasury to issue more bonds; thus the supply of bonds increases. The supply curve, Bs, shifts to the right and the equilibrium interest rate rises. Some economists believe that when the Treasury issues more bonds, the demand for bonds increases because the issue of bonds increases the public's wealth. In this case, the demand curve, Bd, also shifts to the right, and it is no longer clear that the equilibrium interest rate will rise. Thus there is some ambiguity in the answer to this question.

9. The price level effect has its maximum impact by the end of the first year, and since the price level does not fall further, interest rates will not fall further as a result of a price level effect. On the other hand, expected inflation returns to zero in the second year, so that the expected inflation effect returns to zero. One factor producing lower interest rates thus disappears, so, in the second year, interest rate may rise somewhat from their low point at the end of the second year.

11. If the public believes the president's program will be successful, interest rates will fall. The president's announcement will lower expected inflation so that the expected return on goods decreases relative to bonds. The demand for bonds increases and the demand curve, Bd, shifts to the right. For a given nominal interest rate, the lower expected inflation means that the real interest rate has risen, raising the cost of borrowing so that the supply of bonds falls. The resulting leftward shift of the supply curve, Bs, and the rightward shift of the demand curve, Bd, causes the equilibrium interest rate to fall.

13. Interest rates will rise. The expected increase in stock prices raises the expected return on stocks relative to bonds and so the demand for bonds falls. The demand curve, Bd, shifts to the left and the equilibrium interest rate rises.

15. The slower rate of money growth will lead to a liquidity effect, which raises interest rates, while the lower price level, income, and inflation rates in the future will tend to lower interest rates. There are three possible scenarios for what will happen: (a) if the liquidity effect is larger than the other effects, then interest rates will rise; (b) if the liquidity effect is smaller than the other effects and expected inflation adjusts slowly, then interest rates will rise at first but will eventually fall below their initial level; and (c) if the liquidity effect is smaller than the expected inflation effect and there is rapid adjustment of expected inflation, then interest rates will immediately fall.

RISK AND TERM STRUCTURE OF INTEREST RATES

1. The bond with a C rating should have a higher interest rate because it has a higher default risk, which reduces its demand and raises its interest rate relative to that on the Baa bond.

3. During business cycle booms, fewer corporations go bankrupt and there is less default risk on corporate bonds, which lowers their risk premium. Similarly, during recessions, default risk on corporate bonds increases and their risk premium increases. The risk premium on corporate bonds is thus anticyclical, rising during recessions and falling during booms.

5. If yield curves on average were flat, this would suggest that the risk premium on long-term relative to short-term bonds would equal zero and we would be more willing to accept the expectations hypothesis.

7. (a) The yield to maturity would be 5 percent for a one-year bond, 5.5 percent for a two-year bond, 6 percent for a three-year bond, 6 percent for a four-year bond, and 5.8 percent for a five-year bond; (b) The yield to maturity would be 5 percent for a one-year bond, 4.5 percent for a two-year bond, 4 percent for a three-year bond, 4 percent for a four-year bond, and 4.2 percent for a five-year bond. The upward and then downward-sloping yield curve in (a) would tend to be even more upward-sloping if people preferred short-term bonds over long-term bonds because long-term bonds would then have a positive risk premium. The downward- and then upward sloping yield curve in (b) also would tend to be more upward-sloping because of the positive risk premium for long-term bonds.

9. The steep upward-sloping yield curve at shorter maturities suggests that short-term interest rates are expected to rise moderately in the near future because the initial, steep upward slope indicates that the average of expected short-term interest rates in the near future are above the current short-term interest rate. The downward slope for longer maturities indicates that short-term interest rates are eventually expected to fall sharply. With a positive risk premium on long-term bonds, as in the preferred habitat theory, a downward slope of the yield curve occurs only if the average of expected short-term interest rates is declining, which occurs only if short-term interest rates far into the future are falling. Since interest rates and expected inflation move together, the yield curve suggests that the market expects inflation to rise moderately in the near future but fall later on.

11. The government guarantee will reduce the default risk on corporate bonds, making them more desirable relative to Treasury securities. The increased demand for corporate bonds and decreased demand for Treasury securities will lower interest rates on corporate bonds and raise them on Treasury bonds.

13. Abolishing the tax-exempt feature of municipal bonds would make them less desirable relative to Treasury bonds. The resulting decline in the demand for municipal bonds and increase in demand for Treasury bonds would raise the interest rates on municipal bonds, while the interest rates on Treasury bonds would fall.

15. The slope of the yield curve would fall because the drop in expected future short rates means that the average of expected future short rates falls so that the long rate falls.

FOREIGN EXCHANGE MARKET

1. You are more likely to drink California wine because the franc appreciation make French wine relatively more expensive than California wine.

5. In the long run, the fall in the demand for a country's exports leads to a depreciation of its currency, but the higher tariffs lead to an appreciation. Therefore, the effect on the exchange rate is uncertain.

7. The dollar will appreciate. Because expected U.S. inflation falls as a result of the announcement, there will be an expected depreciation of the foreign currency and the expected return on foreign deposits will fall. The RETF curve thus shifts in to the left and the equilibrium exchange rate rises.

9. The franc will appreciate. The announcement of tariffs will raise the expected future exchange rate for the franc and so increase the expected appreciation of the franc. Taking France as the foreign country, this means that RETF shifts out to the right, and the dollar exchange rate falls, so the franc appreciates.

11. The dollar will appreciate. The increase in U.S. productivity raises the expected future exchange rate and results in an expected depreciation of the franc, thus lowering the expected return on foreign deposits. The resulting leftward shift of the RETF schedule leads to a rise in the equilibrium exchange rate.

13. The dollar will depreciate. The drop of expected inflation in Europe, which leads to a decline in the foreign interest rate (which is smaller than the drop in expected inflation), leads to a rise in the expected return on foreign deposits because the expected franc appreciation is greater than the decline in the foreign interest rate. The resulting rise in the expected return on foreign deposits shifts the RETF schedule out to the right and the equilibrium U.S. exchange rate falls.

15. Because it is harder to get French goods, people will buy more foreign goods and the French exchange rate in the future will fall. As a result the expected return on franc assets will fall at each exchange rate, RETF will shift in and the value of the franc will fall (value of the dollar will rise).

ECONOMIC ANALYSIS OF FINANCIAL STRUCTURE

1. Financial intermediaries can take advantage of economies of scale and thus lower transactions costs. For example, mutual funds take advantage of lower commissions because the scale of their purchases is higher than for an individual, while banks' large scale allows them to keep legal and computing costs per transaction low. Economies of scale which help financial intermediaries lower transactions costs explains why financial intermediaries exist and are so important to the economy.

3. No. If the lender knows as much about the borrower as the borrower does, then the lender is able to screen out the good from the bad credit risks and so adverse selection will not be a problem. Similarly, if the lender knows what the borrower is up to, then moral hazard will not be a problem because the lender can easily stop the borrower from engaging in moral hazard.

5. The lemons problem would be less severe for firms listed on the New York Stock Exchange because they are typically larger corporations which are better known in the market place. Therefore it is easier for investors to get information about them and figure out whether the firm is of good quality or is a lemon. This makes the adverse selection-lemons problem less severe.

7. Because there is asymmetric information and the free-rider problem, not enough information is available in financial markets. Thus there is a rationale for the government to encourage information production through regulation so that it is easier to screen out good from bad borrowers, thereby reducing the adverse selection problem. The government can also help reduce moral hazard and improve the performance of financial markets by enforcing standard accounting principles and prosecuting fraud.

9. Yes, this is an example of an adverse selection problem. Because a person is rich, the people who are most likely to want to marry him or her are gold diggers. Rich people thus may want to be extra careful to screen out those who are just interested in their money from those who want to marry for love.

11. The free-rider problem means that private producers of information will not obtain the full benefit of their information producing activities, and so less information will be produced. This means that there will be less information collected to screen out good from bad risks, making adverse selection problems worse, and that there will be less monitoring of borrowers, increasing the moral hazard problem.

13. A financial crisis is more likely to occur when the economy is experiencing deflation because firms find that their real burden of indebtedness is increasing while there is no increase in the real value of their assets. The resulting decline in firm's net worth increases adverse selection and moral hazard problem facing lenders, making it more likely a financial crisis will occur in which financial markets do not work efficiently to get funds to firms with productive investment opportunities.

A sharp increase in interest rates can increase the adverse selection problem dramatically because individuals and firms with the riskiest investment projects are the ones who are most willing to pay higher interest rates. A sharp rise in interest rates which increases adverse selection means that lenders will be more reluctant to lend, leading to a financial crisis in which financial markets do not work well and thus to a declining economy.

THE BANKING FIRM AND MANAGEMENT OF FINANCIAL INSTITUTIONS

1. Because if the bank borrows too frequently from the Fed, the Fed may restrict its ability to borrow in the future.

3. The T-accounts for the two banks are as follows:

FIRST NATIONAL BANK

SECOND NATIONAL BANK

Assets Liabilities Assets Liabilities Reserves-$50 Checkable Reserves+$50 Checkable Deposits-$50 Deposits+$50 5. The $50 million deposit outflow means that reserves fall by $50 million to $25 million. Since required reserves are $45 million (10 percent of the $450 million of deposits), your bank needs to acquire $20 million of reserves. You could obtain these reserves by either calling in or selling off$20 million of loans, by borrowing $20 million in discount loans from the Fed, by borrowing $20 million from other banks or corporations, by selling $20 million of securities, or by some combination of all of these.

7. Because when a deposit outflow occurs, a bank is able to borrow reserves in these overnight loan markets quickly; thus, it does not need to acquire reserves at a high cost by calling in or selling off loans. The presence of overnight loan markets thus reduces the costs associated with deposit outflows, so banks will hold fewer excess reserves.

9. To lower capital and raise ROE holding its assets constant, it can pay out more dividends or buy back some of its shares. Alternatively, it can keep its capital constant, but increase the amount of its assets by acquiring new funds and then seeking out new loan business or purchasing more securities with these new funds.

11. In order for a banker to reduce adverse selection she must screen out good from bad credit risks by learning all she can about potential borrowers. Similarly in order to minimize moral hazard, she must continually monitor borrowers see that they are complying with restrictive loan covenants. Hence it pays for the banker to be nosy.

13. False. Although diversification is a desirable strategy for a bank, it may still make sense for a bank to specialize in certain types of lending. For example, a bank may have developed expertise in screening and monitoring a particular kind of loan, thus improving its ability to handle problems of adverse selection and moral hazard.

15. The gap is $10 million ($30 million of rate-sensitive assets minus $20 million of rate-sensitive liabilities). The change in bank profits from the interest rate rise is +0.5 million (5% x $10 million); the interest rate risk can be reduced by increasing rate-sensitive liabilities to $30 million or by reducing rate-sensitive assets to $20 million. Alternatively, you could engage in an interest rate swap in which you swap the interest on $10 million of rate-sensitive assets for the interest on another bank's $10 million of fixed-rate assets.

THE BANKING INDUSTRY: STRUCTURE AND COMPETITION

1. Agricultural and other interests in the U.S. were quite suspicious of centralized power and thus opposed the creation of a central bank.

3. False. Although there are many more banks in the United States than in Canada, this does not mean that the American banking system is more competitive. The reason for the large number of U.S. banks is anticompetitive regulations such as restrictions on banking.

5. Because becoming a bank holding company allows a bank to: (1) circumvent branching restrictions since it can own a controlling interest in several banks even if branching is not permitted, and (2) engage in other activities related to banking that can be highly profitable.

7. Credit unions are small because they only have members who share a common employer or are associated with a particular organization.

9. IBFs encourage American and foreign banks to do more banking business in the United States, thus shifting employment from Europe to the United States.

11. The facts that banks' importance as a source of total credit advanced has shrunk, bank profitability as measured by ROA and ROE has declined, and bank failures have been running at much higher rates starting in the 1980s.

13. True. Higher inflation helped raise interest rates which caused the disintermediation process to occur and which helped create money market mutual funds. As a result banks' lost cost advantages on the liabilities side of their balance sheets and this has led to a less healthy banking industry. However, improved information technology would still have eroded the banks' income advantages on the assets side of their balance sheet, so the decline in the banking industry would still have occurred.

15. Uncertain. The invention of the computer did help lower transaction costs and the costs of collecting information, both of which have made other financial institutions more competitive with banks and have allowed corporations to bypass banks and borrow directly from securities markets. Therefore, computers were an important factor in the decline of the banking system. However, another source of the decline in the banking industry was the loss of cost advantages for the banks in acquiring funds, and this loss was due to factors unrelated to the invention of the computer, such as the rise in inflation and its interaction with regulations which produced disintermediation.

ECONOMIC ANALYSIS OF BANKING REGULATION

3. Chartering banks is the bank regulation that helps reduce the adverse selection problem because it attempts to screen proposals for new banks to prevent risk-prone entrepreneurs and crooks from controlling them. It will not always work because risk-prone entrepreneurs and crooks have incentives to hide their true nature and thus may slip through the chartering process.

5. The benefits of a too-big-to-fail policy are that it makes bank panics less likely. The costs are that it increases the incentives or moral hazard by big banks who know that depositors do not have incentives to monitor the bank's risk-taking activities. In addition, it is an unfair policy because it discriminates against small banks.

7. Regulatory forbearance is a dangerous strategy because once a bank is insolvent it has even stronger incentives to commit moral hazard and take on excessive risk. It has little to lose if its risky activities go sour, but has a lot to gain if the risky activities pay off. The resulting excessive risk taking makes it more likely that the deposit insurance agency will suffer large losses.

9. The Bank Insurance Fund of the FDIC was recapitalized by allowing it to borrow more from the Treasury and by raising insurance premiums. The bill reduced the scope of deposit insurance by limiting brokered deposits and by limiting the too-big-to-fail doctrine by forcing the FDIC to use the least cost method of closing failed banks except under unusual circumstances. The bill has prompt corrective action provisions that requires the FDIC to intervene earlier with stronger actions when banks move into one of the weaker of the five classifications based on bank capital. The limiting of deposit insurance and prompt corrective action should reduce moral hazard risk-taking on the part of banks. The bill instructs the FDIC to come up with risk-based premiums which will increase the premium cost when the banks take on more risk, thus helping to reduce the moral hazard problem. The bill also mandates increased reporting requirements and annual examinations to prevent the banks from taking on too much risk. It also enhances regulation of foreign banks in the U.S. to keep then from operating in the U.S. if they are taking on too much risk.

11. The S&L crisis can be blamed on the principal-agent problem because politicians and regulators (the agents) have not had the same incentives to minimize costs of deposit insurance as do the taxpayers (the principals). As a result, politicians and regulators relaxed capital standards, removed restrictions on holdings of risky assets and engaged in regulatory forbearance, thereby increasing the cost of the S&L bailout.

13. In general yes. A national banking system will enable banks to diversify their loan portfolios better, thus decreasing the likelihood of bank failures. In addition it may make banks and hence the economy more efficient and will help increase banks' profitability which will make them healthier.

Market-value accounting for bank capital would let the deposit insurance agency know quickly if a bank was falling below its capital requirement so that it could be closed down before it led to substantial losses for the insurance agency. Also it would help keep banks from operating with negative capital when the moral hazard problem becomes especially severe and the bank takes on excessive risk. However, making market-value calculations of bank capital accurate is a complex task since it would require some estimates and approximations. However, even if not fully accurate, if market-value accounting provides a more accurate assessment of bank capital than historical-cost accounting, it would lead to lower losses from the deposit insurance agency.

Chapter 15

THE STRUCTURE OF CENTRAL BANKS AND THE FEDERAL RESERVE SYSTEM

2. The placement of two banks in the Midwest farm belt might have been engineered to placate farmers, an important voting block in the early twentieth century.

4. The Federal Reserve Banks influence the conduct of monetary policy through their administration of the discount facilities at each bank and by having five of their presidents sit on the FOMC, the main policymaking arm of the Fed.

6. The 14-year terms do not completely insulate the governors from political influence. The governors know that their bureaucratic power can be reined in by congressional legislation and so must still curry favor with both Congress and the President. Moreover, in order to gain additional power to regulate the financial system, the governors need the support of Congress and the President to pass favorable legislation.

8. The Fed is more independent because its substantial revenue from securities and discount loans allows it to control its own budget.

10. The theory of bureaucratic behavior indicates that the Fed will want to acquire as much power as possible by requiring all banks to become members. Although the Fed did not succeed in obtaining legislation requiring all banks to become members of the system, it was successful in getting Congress to legislate extension of many of the regulations that were previously imposed solely on member banks (for instance, reserve requirements) to all other depository institutions. Thus the Fed was successful in extending its power.

12. Eliminating the Fed's independence might make it more shortsighted and subject to political influence. Thus, when political gains could be achieved by expansionary policy before an election, the Fed might be more likely to engage in this activity. As a result, more pronounced political business cycles might result.

14. Uncertain. Although independence may help the Fed take the long view, because its personnel are not directly affected by the outcome of the next election, the Fed can still be influenced by political pressure. In addition, the lack of Fed accountability because of its independence may make the Fed more irresponsible. Thus it is not absolutely clear that the Fed is more far sighted as a result of its independence.

Chapter 16

MULTIPLE DEPOSIT CREATION AND THE MONEY SUPPLY PROCESS

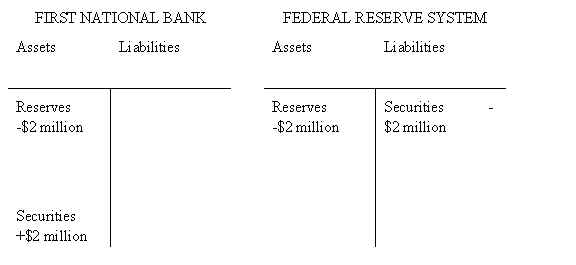

1. Reserves and the monetary base fall by $2 million, as the following T-accounts indicate:

4. None.

6. The Fed sale of bonds to the First National Bank reduces reserves by $2 million; the T-accounts are identical to those in the section entitled "Multiple Deposit Contraction," except that all the entries are multiplied by 20,000 (that is, -$100 becomes -$2 million). The net result is that checkable deposits decline by $20 million.

8. The total increase in checkable deposits is only $5 million, substantially less than the $10 million that occurs when no excess reserves are held. The reason is that banks now end up holding 20 percent of deposits as reserves and only lend out 80 percent, so that the increase in deposits found in the T-accounts is $1,000,000 + $800,000 + $640,000 + $512,000 + $409,600 + . . . = $5 million.

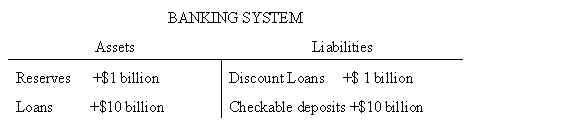

10. The banking system is still not in equilibrium because there continues to be $100 million of excess reserves (= $1 billion of reserves minus $900 million of required reserves, 10 percent of the $9 billion of deposits). The excess reserves will be lent out until equilibrium is reached with an additional $1 billion of checkable deposits. The T-account for the banking system when it is in equilibrium is as follows:

12. $500 = $100/0.2, as the formula in Equation (1) indicates.

14. None. The reduction of $10 million in discount loans and increase of $10 million of bonds held by the Fed, leaves the level of reserves unchanged so that checkable deposits remain unchanged.

Chapter 17

DETERMINANTS OF THE MONEY SUPPLY

2. False. There would still be leakage into currency and excess reserves that would limit the increase in deposit expansion. We can also see this in Equation (4) because the denominator will not equal zero if rD = 0; therefore the money multiplier will not be infinite.

4. The rise in banks' holdings of excess reserves relative to checkable deposits meant that the banking system in effect had fewer reserves to support checkable deposits. Thus the money multiplier fell and this led to a decline in the money supply.

6. M1 remains unchanged, while M2 (which includes money market mutual fund balance) increases. When Jane's funds go to the money market mutual fund, they are first deposited in the mutual fund's bank account, leaving reserves in the banking system unchanged. Because money market mutual funds are not subject to reserve requirements, required reserves are unchanged and the amount of deposits will remain unchanged if depositor ratios remain unchanged. M1 thus remains unchanged, but M2 increases because there are now a larger amount of money market mutual fund shares (which are included in M2).

8. The rise in interest rates in a boom increases the cost of holding excess reserves and the incentives to borrow from the Fed. Therefore, {ER/D} falls, which increases the amount of reserves available to support checkable deposits, and the volume of discount loans increases, which raises the monetary base. The result is a higher money supply during a boom. Similarly, when interest rates fall during a recession, the money supply also has a tendency to fall because {ER/D} rises and the volume of discount loans falls.

10. The level of {ER/D} would rise because excess reserves would be more attractive to hold because of the interest they would earn.

12. The money supply falls. The rise in {C/D} means that there has been a shift from deposits which undergo multiple expansion to currency which does not. Thus overall level of multiple expansion declines, and the money multiplier and money supply fall.

14. The increase in loan demand will cause interest rates to rise. The rise in interest rates increases the cost of holding excess reserves and the incentives to borrow from the Fed. Therefore, {ER/D} falls, which increases the amount of reserves available to support checkable deposits, and the volume of discount loans increases, which raises the monetary base. The result is a higher money supply.

Chapter 18

TOOLS OF MONETARY POLICY

2. When the public's holding of currency increase during Christmas, the currency-checkable deposits ratio increases and the money supply falls. To counteract this decline in the money supply, the Fed will conduct a defensive open market purchase.

4. Because the decrease in float is only temporary, the monetary base is expected to decline only temporarily. A repurchase agreement only temporarily injects reserves into the banking system, so it is a sensible way of counteracting the temporary decline in the monetary base due to the decline in float.

6. False. The Fed also can affect the level of discount loans by directly limiting the amount of discount loans an individual bank can have.

8. True. Banks would not make a profit by borrowing from the Fed and making loans with the proceeds if the discount rate was above the loan rate. Thus they would not borrow from the Fed to make a profit and there would be no need for the Fed to administer the discount window.

10. The costs are that banks that deserve to go out of business because of poor management may survive because of Fed discounting to prevent panics. This might lead to an inefficient banking system with many poorly run banks.

12. When interest rates rise during a boom, the spread between market interest rates and the discount rate usually rises and the level of discount loans increase. The result is a rise in the monetary base and the money supply during a boom. Similarly, during a recession, when interest rates rise, the level of discount loans falls, which reduces the monetary base.

14. One problem with this proposal is that it provides perfect control over the official measure of the money supply, but it may weaken control over the measure of the money supply that is economically relevant. An additional problem is that it will result in a costly restructuring of the financial system, as banks are forced to get out of the loan business.

Chapter 19

THE CONDUCT OF MONETARY POLICY: TARGETS AND GOALS

2. (a) The three-month Treasury bill rate can be thought of as either an operating target or an intermediate target. It can be an operating target because it is a variable that can be affected directly by the tools of the Fed (open market operations, in particular). It can be an intermediate target because it has some direct effect on economic activity. (b) The monetary base is an operating target because it can be directly affected by the tools of the Fed and is only linked to economic activity through its effect on the money supply. (c) M1 is an intermediate target because it is not directly affected by the tools of the Fed and has some direct effect on economic activity.

4. The increase in money demand that shifts the money demand curve to the right would raise interest rates. In order to prevent this, the Fed will buy bonds, bidding up their price and lowering their interest rates back down to the target level. The open market purchase will then cause the monetary base and the money supply to rise.

6. The monetary base is more controllable than M1 because it is more directly influenced by the tools of the Fed. It is measured more accurately and quickly than M1 because the Fed can calculate the base from its own balance sheet data, while it constructs M1 numbers from surveys of banks, which takes some time to collect and are not always that accurate. Even though the base is a better intermediate target on the grounds of measurability and controllability, it is not necessarily a better intermediate target because its link to economic activity may be weaker than that between M1 and economic activity.

8. The sharp rise in the discount rate caused banks to reduce the amount of their discount loans from the Fed, thus reducing the monetary base and causing the money supply to fall.

10. No. The rise in reserve requirements in 1936-1937 caused banks to contract their loans in order to beef up the level of excess reserves when they were reduced by the increase in required reserves. This indicates that the banks did not view these excess reserves as being idle at all; they were viewed as being necessary protection against deposit outflows.

12. Not necessarily. The failure of the Fed to control the money supply may be more attributable to poor Fed operating procedures and its weak commitment to control of the money supply.

14. Bank behavior can lead to procyclical money growth because when interest rates rise in a boom, they decrease excess reserves and increase their borrowing from the Fed, both of which lead to a higher money supply. Similarly, when interest rates fall in a recession, they increase excess reserves and decrease their borrowing from the Fed, leading to a lower money supply. The result is that the money supply will tend to grow faster in booms and slower in recessions--it is procyclical. Fed behavior also can lead to procyclical money growth because (as the answer to problem 1 indicates) an interest-rate target can lead to a slower rate of growth of the money supply during recessions and a more rapid rate of growth during booms.

Chapter 22

THE INTERNATIONAL FINANCIAL SYSTEM AND MONETARY POLICY

1. The purchase of dollars involves a sale of foreign assets which means that international reserves fall. However, the offsetting open market purchase means that the monetary base and the money supply will remain unchanged. If dollar and foreign deposits are perfect substitutes, then there is no effect on the exchange rate because neither the RETF or RETD schedules shift since there is no change in the money supply.

3. (a) A receipt in the capital account; (b) a payment in the current account; (c) a receipt in the method of financing; (d) a receipt in the current account; (e) a payment in the current account; (f) a payment in the capital account; and (g) a receipt in the capital account.

5. The increase in British productivity would create a tendency for the pound to appreciate relative to the dollar. The higher value of the pound would now cause Americans to exchange dollars for gold, ship the gold to Britain, and then buy British pounds with the gold. The result is that British holdings of gold (international reserves) would increase, which would raise the money supply because the monetary base would increase. The higher British money supply would then tend to lower the exchange rate back down to its par level because it would cause the price level to rise, which would lead to a depreciation of the pound.

7. The situation would be as depicted in Figure 2, Panel (b). The central bank would need to sell domestic currency and buy foreign assets, thus increasing its international reserves and the monetary base. The resulting rise in the money supply would then lead to a decline in the domestic interest rate which would shift RETD in to the left so that the equilibrium exchange rate would be at par.

9. True, because when the exchange rate is falling, the central bank must buy its currency, which lowers its holdings of international reserves and its monetary base. Similarly, when the exchange rate is rising, it must sell its currency, which raises its holdings of international reserves and its monetary base. The necessary central bank intervention to keep its exchange rate fixed thus affects the monetary base and hence the money supply.

11. False. As seen in the chapter, a reserve currency country, such as the United States, can have its balance of payments deficits financed by foreign central banks, leaving its international reserves unchanged.

13. False. Inflation occurred when the world was under the gold standard before World War I. The gold discoveries in the Klondike and South Africa before World War I led to a continuing increase in the quantity of gold, which caused a more rapid growth in money supplies throughout the world. The result was worldwide inflation.

15. Uncertain. Although after 1973, countries no longer must intervene in the foreign exchange market to keep their currencies at a par level and so could pursue more independent monetary policy, they have not chosen to do so; rather, they have continued to engage in substantial intervention in the foreign exchange market. Thus they continue to have substantial fluctuations in international reserves, which affect their money supply.