The Federal Republic of Germany is located in the heart of Europe. It is approximately 137,826 square miles, about the size of Montana. There are over 82.4 million people living in Germany as of July 2004. Therefore, there are 230 inhabitants per square mile, which makes Germany the most densely populated country in Europe. However, Germany has one of the lowest birthrates with nine births per 1000 persons per year. In addition, Germany is a democratic and socially responsible federal country. A Federal Chancellor runs the government, and is elected over a four-year term with no limitation on re-election. Furthermore, Germany has the fifth largest national economy in the world but has a high unemployment rate of 10.5% in 2003. Therefore, with high unemployment rates, low birth rates, and an aging population, Germany is currently faced with the problem of financing its retirement and health care policies.

![]()

Germany’s retirement program consists of a social security system and statutory pension insurance. The social security system has three types of programs: contributory social insurance programs, noncontributory social compensation program, and social welfare program. The contributory social insurance programs protect those who pay into them from loss of income and unplanned expenses because of old age or disability, as well as illness, accident, and unemployment. The noncontributory social compensation program provides a tax-financed social welfare program for those in the military or public service. The social welfare program provides social aid to those who are not eligible under the contributory social insurance and noncontributory social compensation programs.

Germany’s pension insurance was placed to ensure that workers continue to have an adequate standard of living during their retirement. It currently insures over 50 million people with an annual budget of over 220 billion Euros. Thus, about 80 percent of the working population is covered under the system.

In 2004, employers and employees contribute 9.75 percent each of the employee’s gross monthly income into the insurance program. The amount contributed is not accumulated by investing the proceeds on behalf of the employee. Instead, once the employee retires, pension insurance is paid from the program’s current income by means of an allocation process. Currently, in West Germany, the average old-age pension for men is 980 Euros and for women is 644 Euros. In East Germany, men receive an average of 1030 Euros and women receive 830 Euros. In addition, pensions are adjusted every year to reflect any cost of living increases.

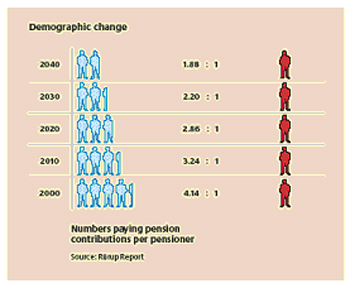

However, with rising life expectancy coupled with low birth rate, there will be an unfavorable ratio of working people to pensioners. According to statistics, the current residual life expectancy of a 65-year-old woman will increase from 19.5 years to an estimated 20.8 years in 2010. For men, it will increase from 15.8 to 17.1 years. And by 2030, the working age population (15 to 64 years old) will shrink by over 7 million while the number of eligible pensioners will rise to over 22 million. Therefore, Germany is faced with the challenge of continuing to guarantee its citizens’ social security and pension insurance without increasing the demands of the working population to pay higher taxes and contributions.

The following graph shows that in the years to come, the number of paying pension contributions per pensioner will decrease:

Therefore, Germany enacted the 2010 reform agenda in its efforts to ensure that employee and employer contributions toward financing the statutory pension insurance remain stable. One of the reforms implemented was postponing the increase in pensions from July 2004 to July 2005. It also proposes that between 2001 and 2035, the age at which citizens are eligible for state pensions should rise from 65 to 67. Furthermore, increases in pensions are to be reduced while contributions will remain stable, despite demographic trends and higher life expectancy. Thus, the current pension level of 48% of gross earnings will decrease to around 42% by 2030. Therefore, officials are hoping that German workers will take their own measures toward saving for their own retirement, either directly or through company plans.

Some businesses are also taking actions towards Germany’s pension problems by reducing pension benefits that could cut some higher-paid workers up to 50 percent in their company-paid pensions. One large German bank, Commerzbank, plans to halt its pension plan in 2005. Therefore, workers hired after that date will not receive any pensions from that company. Gerling, another German company, is cutting pension benefits between 30 to 50 percent for employees hired after 1998, and are placing a ceiling on benefits, which will impact the highly paid workers. Thus, workers must take more personal responsibility towards their retirement if they would like to ensure a comfortable life during this stage.

Germany’s efforts under the 2010 Reform Agenda maybe sufficient to ensure that it’s pension insurance scheme remain stable. However, since pension payments will not only be cut, but also be delayed, Germany should also assists its workers by offering some basic information on investing to provide them an alternative on saving for retirement.

![]()

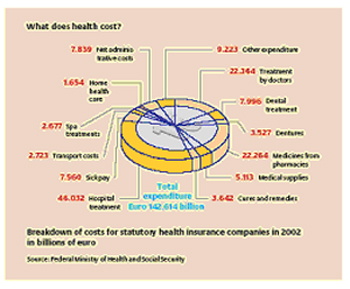

Germany’s health care system provides access to comprehensive high-quality medical care and choice of physicians to its residents through the country’s statutory health care insurance program also known as the GKV. Over 90 percent of the population currently receives health care through this program. It relies on about 1,200 nonprofit sickness funds that collect premiums from their members and pay health care providers according to negotiated agreements. Civil servants and the self-employed do not qualify for this program. Instead, they receive health care through private for-profit insurance companies. Those qualified are obliged to join one of the over 315 statutory health insurance schemes. But everyone uses the same health care facilities.

Employers and employees each pay half of a member’s premiums, which currently stood on average of 14 percent of the member’s gross earnings. Employees with families who do not work do not have to make contributions to the program. Thus, employees with families are better off than single employees.

According to the German health ministry concluded in May 2003, Germany’s health care system is suffering from a lack of competition, shrinking revenue, and an aging population. Thus, the Rurup Commission, named after Bernd Rurup, a professor of economics, has made suggestions to sustain the financing of the health care system. To solve the problem, Rurup advocates suggests that the contribution scheme would be maintained, but the number of contributors be increased, by including civil servants and the self-employed into the system. Another suggestion was for a “flat-rate health contributions”, whereby all those insured would pay a flat rate contribution toward insurance, regardless of income.

The government has also set up a health reform package in the 2010 reform agenda to help fix the problem of rising health care costs. It states that by 2006, health care costs will be reduced to EUR 23 billion. Thus, contributions will fall below 13 percent instead of 14 percent of workers’ gross income. With these measures, Germany’s government is hoping that the health care system will remain financially viable in the future.

Furthermore, since January 1, 2004, members are now obliged to pay 10 Euros per quarter to see a general practitioner. Although preventive check-ups, referrals within the same quarter, or children under 18 years of age are exempt from this fee. Members must also contribute towards the cost of prescription drugs as well as services such as wound dressings, in-patient preventive treatment and rehabilitation, out-patient rehabilitation, and in-patient hospital care. However, the maximum limits for additional payments will be 2 percent of a worker’s gross annual income, and is reduced to 1 percent if it involves chronic illness.

In addition, starting in 2006, the health reform will demand a health smart card from each insured persons, which will have information that will help avoid expensive multiple examinations. In addition, maternity benefits will be financed by increased taxation in tobacco. Furthermore, dentures will be covered by paying a separate premium starting in 2005, as well as sick pay starting in 2006.

The Rurup Commission suggestion of increasing the number of contributors in the system is a good idea on helping finance the health care system. Furthermore, the 2010 reform agenda have provided ways to ensure the health care system is well funded. Another recommendation would be to require a premium for employees with families who do not work to make contributions into the programs. Retired persons as well as children under 18 years of age will still be exempt.

![]()

Agenda 2010 Deutschland Bewegtsich [http://www.cia.gov/cia/publications/factbook/geos/gm.html]

Agenda 2010 Deutschland Bewegtsich [http://www.cia.gov/cia/publications/factbook/geos/gm.html] Facts About Germany [http://www.tatsachen-ueber-deutschland.de/389.0.html]

Facts About Germany [http://www.tatsachen-ueber-deutschland.de/389.0.html] Health Care in Germany [http://www.nchc.org/facts/Germany.pdf]

Health Care in Germany [http://www.nchc.org/facts/Germany.pdf] Health Care in German Society [http://www.germanculture.com.ua/library/facts/bl_health_care.htm]

Health Care in German Society [http://www.germanculture.com.ua/library/facts/bl_health_care.htm] In Germany, shifting the cost of pension to the workerThe World Factbook [http://www.globalaging.org/pension/world/2004/shifting.htm.]

In Germany, shifting the cost of pension to the workerThe World Factbook [http://www.globalaging.org/pension/world/2004/shifting.htm.] Provision of the Social Welfare System [http://reference.allrefer.com/country-guide-study/germany/germany77.html]

Provision of the Social Welfare System [http://reference.allrefer.com/country-guide-study/germany/germany77.html] The World Factbook [http://www.cia.gov/cia/publications/factbook/geos/gm.html]

The World Factbook [http://www.cia.gov/cia/publications/factbook/geos/gm.html] Welcome to Germany Info [http://www.germany-info.org/relaunch/info/facts/government.html]

Welcome to Germany Info [http://www.germany-info.org/relaunch/info/facts/government.html]