Support Page Content

Master of Science in Accountancy

Join us for a Virtual Information Session to learn more about the MS in Accountancy (MSA) program.

This session will cover program structure, curriculum, admissions requirements, and how the MSA can support your career goals in accounting.

- February 26, 2026

- 1:00 pm - 2:00 pm (PST)

You'll also have the opportunity to ask questions and connect with our graduate program team.

Registration is required.

REGISTER HERE! MSA Virtual Info Session

Elevate Your Career with Our MSA Program

Sacramento State’s online Master of Science in Accountancy (MSA) Program provides an advanced understanding of the rapidly evolving accounting field. The MSA program equips students with the necessary skills and knowledge to pursue industry certifications such as the CPA and the CMA. This is achieved through the completion of professional training and meeting the requirements for professional exams.

The MSA curriculum is compatible with the CPA exam, training students in all areas of the CPA exam including:

- AUD: Auditing Attestation

- FAR: Financial Accounting and Reporting

- REG: Regulation

- BEC: Business Environment and Concepts

The Master of Science in Accountancy (MSA) Program employs a comprehensive fully online approach, utilizing a blend of online course materials. This distance education model significantly enhances flexibility for students, allowing them to complete the program on their terms. The courses are available year-round in an accelerated format, enabling students to complete the entire program in an attractive time frame.

Fall 2026 Application is currently OPEN!

MSA Program Highlights and Cost

The MSA is a partnership program with the College of Continuing Education (CCE).

Accelerated Format

- 18 month program

Flexible Scheduling

- One course at a time (each course is 6 weeks)

- Asynchronous work

- Fully online

Outstanding faculty

- Scholar with industry experience

Quality Accredited Program

- AACSB accredited program

- Assurance of student learning

Additional Resources

Request Info Now! * MS - Accountancy * Start Your Journey Here!

Tuition

Courses are administered by the College of Continuing Education (CCE). Students must register for all classes through the CCE as well as paying a per-unit fee for each class. The fees for the Program Requirement and Elective courses are currently $740 per unit paid through the CCE. Please note that other fees such as health insurance may also be applicable..

Total cost of the program: $22,200.

Financial Aid

At this time, no merit scholarships are available to new students. The MSA program does not provide graduate assistantships.

Financial Aid is processed through the College of Continuing Education (CCE) and may be available for students pursuing the online MSA degree. We recommend starting the financial aid process as early as possible by completing the Free Application for Federal Student Aid (FAFSA). More information can be found through CCE"s website here.

A full list of scholarships available at Sac State can be found here. The Office of Graduate Studies may also provide additional opportunities to pursue and can be found here..

Military and Veteran Students

If you are an Active Military and or a Veteran Student and have questions regarding your benefits, please reach out to our Veterans Student Support & Compliance Specialist at the following:

Veterans: cce-veterans@csus.edu

Department of Rehabilitation (DOR): cce-dor@csus.edu

CalJobs: cce-caljobs@csus.edu

For further Program Information, please contact:

Pheng Yang, MAFM

Graduate Student Recruitment & Admissions Coordinator

(916) 278-5767

cobgraduateadmissions@csus.edu

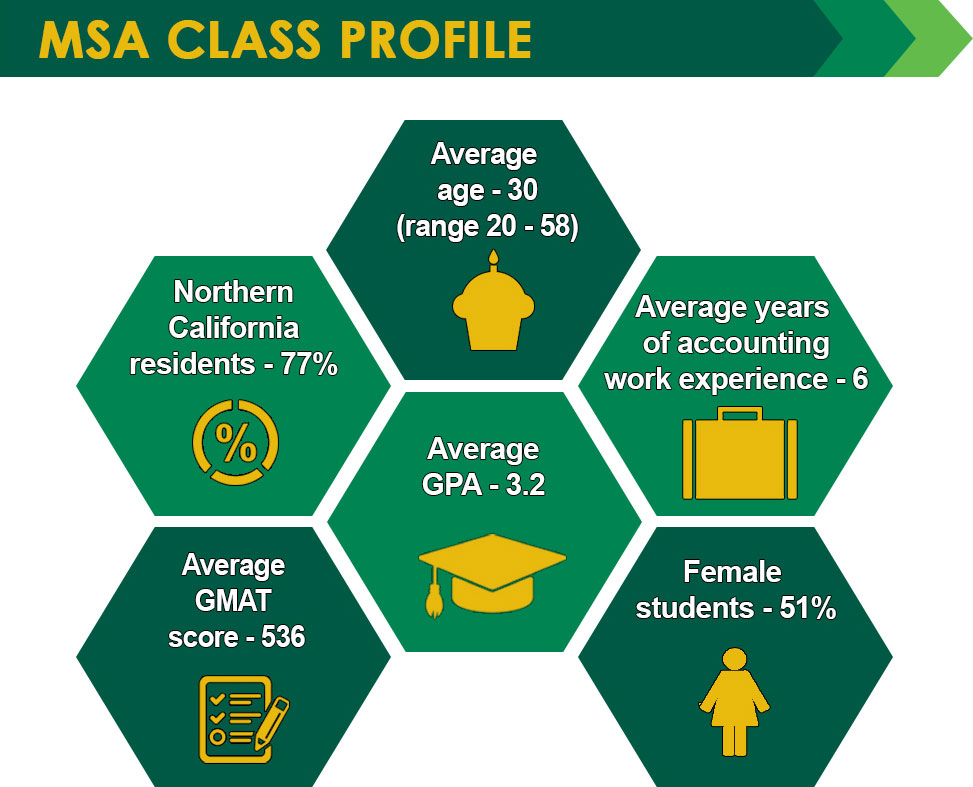

Class Profile and Minimum Academic Qualifications

- Undergraduate degree from an accredited institution with a 2.50 overall GPA

- No exams required for admission (GMAT or GRE not required).The College of Business has waived the admission test requirement for ALL applicants to the MS Accountancy degree. You do not need to submit a valid GMAT or GRE score as part of your application nor to be admitted to the program. The waiver is automatic; no waiver form is required.

- International students must obtain a minimum TOEFL of 550 (paper-based) or 80 (Internet-based), or an IELTS score of 6.5

MSA Application Information: Fall 2026

Fall 2026 applications opened on October 1, 2025 and the deadline is March 1, 2026.

NOTE: You must complete the entire application process and pay the $70 fee by the appropriate deadline to be considered an applicant to the program. Incomplete applications will not be reviewed.

Please follow the directions carefully below to be considered for the MSA Spring 2026 program. Applicants will need to submit the following

Complete a Cal State Apply Application and pay $70 application fee

Add Program: Business Administration - Accountancy is located under Sacramento Extension

- Complete the Personal Information, Academic History, and Supporting Information Sections- Under Program Materials, applicants will submit the following:

- Current resume: 1-2 pages

- Request for two letters of recommendation: Applicants will enter name and an email request will automatically be sent to the recommender on your behalf. Please advise your recommender to look for this email in their inbox, as well as their spam or junk-mail folder, as emails do occasionally get filtered out. Recommenders can complete the Recommendation Form or write their own letter and upload directly through the email portal. Please see page 27 of these instructions for more details on the recommendation submission process.

Copies of official transcripts from all colleges and universities attended, other than Sacramento State sent electronically to gradtranscripts@csus.edu or hard copy to:

Office of Graduate Studies

California State University, Sacramento

Riverfront Center, Room 215, MS 6112

6000 J St.

Sacramento, CA 95819

Academic Curriculum

New for Spring 2026: The MSA Program has waived the following two foundation courses for the Spring 2026 program: ECON 204 Business Economics and MBA 203 Legal Environment of Management

One foundation course should be completed prior to taking the MSA Program Requirement courses. This course is not offered through Sacramento State in Spring 2026.

(2) MBA 201 Accounting

MBA 201 has lower division course equivalencies. We will accept courses from non-AACSB accredited universities as well as from community colleges to waive this specific course. It must have been completed within seven (7) years of the date of admission. The courses that are considered equivalent for waiver are as follows:

• MBA 201 Accounting can be waived by taking a Financial Accounting course with a "C" grade or higher

While foundation courses do not affect your admissibility and are not required to be completed prior to admission to the program, this course must be completed before you start the MSA program requirement coursework with a "C" grade or higher. Foundation course waivers are available and are determined either at the time of admission, or upon a request for waiver by the student after application.

The MSA Program requires 30 units and is composed of two parts:

• Program Requirements (27 units)

• Culminating Experience (3 units)

- Program Requirements (27 units)

• ACCY 250 Financial Reporting I

• ACCY 260 Financial Reporting II (Prerequisite: ACCY 250)

• ACCY 261 Cost Analysis and Control

• ACCY 262 Auditing

• ACCY 263 Governmental and Not-for-Profit Accounting

• ACCY 264 Taxation of Business Entities

• ACCY 265 Advanced Accounting Information Systems Analysis and Controls

• ACCY 266 Business Environment and Concepts

• ACCY 269 Taxation of Individuals - Culminating Experience (3 units)

• ACCY 501 Culminating Experience Project in Accounting and Ethics (Prerequisite: Advanced to Candidacy)

MSA Frequently Asked Questions

Does the MSA Program accommodate working professionals?

Yes, many of our students are full-time working professionals. The distance education delivery mode used by the MSA program vastly increases the flexibility by which students can complete their degree online. All of the courses are offered on a year-round schedule in an accelerated format and each course is 6 weeks in duration. Please see our current student schedules below as samples.

How are the online courses for the MSA Program taught?

The MSA program courses utilize a Virtual Classroom environment including a combination of online course materials, streaming video, audio, electronic bulletin boards, lecture resources with direct links to other course materials, lecture notes, full audio of lectures (asynchronous), video of portions of lectures, links to relevant materials, Chat Live office hours (synchronous), Online assessments and instant messaging to deliver a completely web-based degree.

Can I apply if my undergraduate degree is in a non-business field?

Yes, we encourage students of all fields to pursue our MSA Program. Please note if you have not taken the foundation course listed above (Financial Accounting), you will need to complete this course prior to enrolling in the program requirement courses. You may apply without completing this foundation course and complete this course through a community college before enrolling in the MSA program. For example, if you have not competed the foundation courses by Spring 2025, you may still apply for Spring 2025 and if admitted, you can take the foundation course prior to the start of the your first MSA course (ACCY 250).

Do I need to complete the Foundation Courses prior to applying for the program?

No. You can apply to our MSA program without having completed the foundation Courses at the time of the application. While it does not affect your admissibility and it is not required to be completed prior to admission to the program, it must be completed before you start the MSA program requirement coursework and must receive a "C" grade or higher in the course. When you apply, we will evaluate your transcripts to determine which courses you have completed. If you do not initially meet our waiver requirements, you can submit a petition along with supporting documentation including course syllabi, statement explaining how professional work experience has provided appropriate knowledge for each specific foundation course, a current resume, a current job description (include a supervisor name and contact information for verification), or proof of professional or academic qualifications to waive out of the foundation courses. Please note that we cannot transfer any credit from your MBA courses to the MSA core courses.

Can I take individual classes without being admitted to the program?

No, all students must be admitted to the MSA Program before enrolling in classes. This includes Foundation Courses.

Does Sacramento State require applicants to have work experience before applying to the MSA degree?

Sacramento State does not require applicants to have work experience before they apply. However, learning may be enhanced for those graduate students who have real-world work experiences to apply towards course concepts. Students admitted into our MSA program have an average of 3.5 years of work experience.

Do I need to submit community college transcripts and/or transcripts from other institutions I attended, even though they are indicated on the University transcripts I graduated from?

Yes. You need to submit transcripts from all institutions that you have attended even if you only took one course. If you are Sacramento State alumni, you only need to submit transcripts not previously submitted to the university.

Can the CSU Employee Fee Waiver and Reduction Program be used for the MSA program?

No. The MSA program is a partnership program between the College of Business and the College of Continuing Education and considered self-support. Fee waiver applies to CSU state-supported (general fund) courses only, including state-supported courses that are offered through summer term. Courses in self-support (i.e. Extended Education) programs may not be taken through the CSU Employee Fee Waiver and Reduction Program.

Current MSA Students

Class Schedules:

Tentative Master Class Schedule for All MSA courses

Class Schedule for Fall 2026 Admitted Students

Class Schedule for Spring 2026 Admitted Students

Class Schedule for Fall 2025 Admitted Students

Class Schedule for Spring 2025 Admitted Students

Tentative Class Schedule for Fall 2024 Admitted Students

Steps to Graduation:

As a current MSA student these Steps to Graduation should be followed in order to meet all the necessary requirements set by the University, CBA and CCE. They were designed to make your graduate degree effortless.

Student Forms:

Advancement to Candidacy (Link to OnBase Forms)

OnBase Forms User Guide - MSA Advancement to Candidacy

Application for Graduation (Link to OnBase Forms)

OnBase Forms User Guide - MSA Application for Graduation

Contact Information

MSA Admissions

Pheng Yang, MAFM

(916) 278-5767

cobgraduateadmissions@csus.edu

MSA Academic Advising

Serena Hoffman

Graduate Programs Advisor

(916) 278-6391

Graduate Programs Office

Pheng Yang, MAFM

Interim Executive Director of Graduate Programs

(916) 278-5767

pheng.yang@csus.edu

Current Students: cbagrad@csus.edu

Prospective Students: cobgraduateadmissions@csus.edu

MSA Program Curriculum

Dr. Hugh Pforsich

MSA Faculty Advisor

(916) 278-7141

Mailing Address

California State University, Sacramento

College of Business - MSA

Tahoe Hall, Room 1020

6000 J Street

Sacramento, CA 95819-6088

COB is in the news!

The Sacramento State College of Business is shaping the next generation of leaders, innovators, and entrepreneurs. Through cutting-edge programs, hands-on learning experiences, and strong industry connections, we empower students to excel in today’s dynamic business world.

Our Graduate programs provide students with the tools to succeed—whether they’re launching startups, driving corporate success, or making an impact in their communities.

With a commitment to student success, collaboration, and real-world application, Sac State’s College of Business is preparing graduates to lead with confidence. Stay tuned for inspiring student stories, faculty insights, and program highlights!

📢 Read more in our exclusive partnership with the Sacramento Business Journal!

MSA Degree Learning Goals

Students will have certain capabilities (knowledge, skills, abilities) that result from your business degree program. At the Sacramento State, we call these capabilities learning outcomes. Learning outcomes are measured and analyzed through a broad range of assessments, from class assignments to standardized exams, to provide assurance of learning in the degree program. From time to time, the College of Business (COB) or your instructors may ask or require you to participate in assessments. We use the information from assessments to reinforce what is working or to make changes to support student learning and success. For example, we may revise curriculum or hire additional staff and faculty to support the needs of our students. We document how our students perform and the actions that we take to continuously improve. This process helps to enhance the student experience and maintain our external accreditation with AACSB International. Speaking of accreditation, less than 5% of business schools worldwide are accredited by AACSB and thus this elite accreditation contributes greatly to the COB reputation. We hope that when you are asked to participate in assessment activities that you will accept the invitation and put your best effort forward.

Goal 1: Technical Knowledge and content

1.1. Students will demonstrate knowledge of standards, principles, laws and regulations applicable to the accounting field.

1.2. Students will analyze economic transactions and apply the analysis to the major areas of decision-making, management control systems and analytics.

Goal 2: Develop and Communicate Critical Information Sets

2.1. Students will construct various accounting reports for decision making purposes.

2.2. Students will effectively evaluate information sources and communicate their judgments to users.

Goal 3: Critical Thinking and Integrative Analyses

3.1. Students will evaluate alternative solutions to business issues in a changing environment.

3.2. Students will collect and integrate various information sources and skills for analyzing business issues.

Goal 4: Business Context and Ethics

4.1. Students will understand regulatory and legal constraints in the accounting and global business environment.

4.2. Students will identify and analyze ethical issues, and make ethical decisions in accounting contexts.

Equal Opportunity and Excellence in Education and Employment

All university programs and activities are open and available to all regardless of race, sex, color, ethnicity or national origin. Consistent with California law and federal civil rights laws, the California State University, Sacramento provides equal opportunity in education and employment without unlawful discrimination or preferential treatment based on race, sex, color, ethnicity, or national origin. Our commitment to equal opportunity means ensuring that every student and employee has access to the resources and support they need to thrive and succeed in a university environment and in their communities. The California State University, Sacramento complies with Title VI of the Civil Rights Act of 1964, Title IX of the Education Amendments of 1972, the Americans with Disabilities Act (ADA), Section 504 of the Rehabilitation Act, the California Equity in Higher Education Act, California’s Proposition 209 (Art. I, Section 31 of the California Constitution), other applicable state and federal anti-discrimination laws, and CSU’s Nondiscrimination Policy. We prohibit discriminatory preferential treatment, segregation based on race or any other protected status, and all forms of discrimination, harassment, and retaliation in all university programs, policies, and practices.

The California State University, Sacramento is a diverse community of individuals who represent many perspectives, beliefs and identities, committed to fostering an inclusive, respectful, and intellectually vibrant environment. We cultivate a culture of open dialogue, mutual respect, and belonging to support educational excellence and student success. Through academic programs, student organizations and activities, faculty initiatives, and community partnerships, we encourage meaningful engagement with diverse perspectives. As a higher education institution, we are dedicated to advancing knowledge and empowering individuals to reach their full potential by prioritizing inclusive curriculum development, faculty and staff training, student mentorship, and comprehensive support programs. At the California State University, Sacramento, excellence is built on merit, talent, diversity, accessibility, and equal opportunity for all.