Support Page Content

Payments to Students

Sacramento State must abide by State, Federal, and CSU System-Wide requirements for making payments to students. Running afoul of these requirements could have the university censured, fined, or lose funding vital to the university's operations.

To follow is information for Sacramento State departments, offices, and units for making payments to students. There are several ways Sacramento State can pay students. The information below outlines each payment type's regulations, requirements, and limitations.

What is the difference between an Independent Contractor and an Employee? CSU Independent Contractor Guidelines

What is Gross Income? - Cornell Law School

What are Qualified Scholarships? - Cornell Law School

Tax Benefits for Education - IRS Publication 970

Sacramento State students may receive payment from the university for assistantships, awards, fellowships, grants, research support, scholarships, traineeships, travel, etc. A payment's type, purpose, and primary beneficiary (student or Sacramento State) determine how it is processed and whether it must be reported to the Internal Revenue Service (IRS) or the Financial Aid Office.

All of the processes below require that the department receive approval of the process they are choosing to use before they use it. An approved Payments to Students Form is required by each department to follow the process below. The approval does not need to be done for every payment and only needs to be completed if the Fund, Class, Department, or process changes. This is a one time extra step.

Select the Payment Type below and navigate the information to learn more.

Payment Types

Assistantships, such as Student Assistants (SAs), Federal Work Study (FWS), Non-Citizen Status Student Assistants (NCS), and Teaching Assistants (TAs), etc., are employees of Sacramento State and are subject to all applicable Federal, State, and Education Code employment requirements and protections. Student Fellows (fellowships) are also employees of Sacramento State. The Student Employment Office, in coordination with other Department of Human Resources departments, manages the verification of and payments to Student Employees.

NOTE: Some Student Employee positions are subject to collective bargaining rights and requirements.

For more information, please see the Student Employment Office webpage. If you still have questions, you can contact the Student Employment Office by phone at (916) 278-1277, by email, or in their offices, Del Norte Hall, Room 3009.

Some units have funds used to pay individuals, including students, for participating in non-employment related activities such as recruitment, public service, STEM promotion, or other activities that involve participant support costs. Though unrelated to employment services, these payments are taxable income to the recipient. These individuals are typically considered independent contractors.

The Independent Contractor process is managed jointly by the Sac State Human Resources Department and Procurement & Contract Services.

Some endowment and gift funds allow payments to students in the form of resource support and scholarships among others. Each fund should possess a specification (spec) sheet that outlines how the fund monies are to be spent. Accounting Services (AS) and Procurement & Contract Services (PCS) are the primary sources for clarification on University and University Foundation (UFSS) funds and their uses.

Sacramento State has no U.S. Department of Education (ED) Title IV financial aid and no IRS Form 1098-T reporting requirements for payments to non-matriculated students. Therefore, these payments are either:

- Wages for services rendered to Sacramento State, in which case they are processed through Payroll Services; or

- Payment for services rendered, in which case they are processed through the Independent Contractor Form

Introduction

Recipients of student prizes or awards are typically selected through a contest, drawing, or competition. Students may also be selected in recognition of charitable, scientific, educational, artistic, literary, or civic achievements.

Restrictions are typically not imposed on how a student can use prizes or awards. Thus, student prizes and awards are not restricted to educational purposes.

If the funding source of the student prize or award is a gift or endowment income fund, then the donor may set the criteria for recipient selection but may not select the actual recipient(s).

It is important to distinguish student prizes and awards from other types of payments to ensure proper financial statement reporting and compliance with the applicable Internal Revenue Service (IRS) reporting and withholding rules. Common examples of payments that are not student prizes and awards include:

- Wages and other payments for employment services. These payments must be processed through Payroll Services.

- Scholarships, Fellowships, and Educational Assistance Grants that are required to be used for:

- Educational expenses

- Travel which primarily benefits the student's education

- Research activities that primarily benefit the student's education

- Room and board

- See details at Scholarships, Fellowships, and Educational Assistance Grants

IRS Reporting

Prizes and Awards are tracked by campus and may be reported to the IRS if an individual receives more than $600 worth of prizes in a calendar year.

We are required to perform due diligence in collecting and reporting payments from the university or her auxiliaries to students, faculty, and staff. These payments may have state and federal tax implications as well as FAFSA eligibility.

Prize and award payments must be reported to the Student Service Center (SSC) for financial aid purposes because they may be considered a financial resource when determining the student's financial aid eligibility. Therefore, these payments may have an impact on the type and amount of financial aid the student is eligible to receive.

SSC will make the necessary adjustments to the student's financial aid upon notification of the payments. These adjustments may create or increase a balance due on the student's university account. Students are encouraged to check their Student Center from MySacState periodically throughout the semester.

Common Forms of Prize and Award monies

Gift Cards: Gift Cards are cash and need to be handled as such. Faculty, staff, and students awarded a gift card of any amount using any form of University funds (Trust, Scholarship, State, Tuition, Student fees, etc.) must officially acknowledge receipt of the gift card and the payment must be reported to tax officials (IRS, State Franchise Tax Board) and FAFSA (students only, including employee students). The purchase of Gift Cards with university funds requires Pre-Approval. Gift Cards purchased with personal monies are exempt and allowable. Purchasing gift cards with personal monies to avoid income tax or FAFSA reporting obligations, and seeking reimbursement from a University entity is tax fraud and will not be tolerated.

Honorariums & Stipends: Sacramento State does not offer honorariums or stipends. Any individual receiving either such payment would be considered an independent contractor.

Introduction

Many units have funds that may be used to pay student research and travel expenses. Before paying a student's research and travel expenses, the unit must determine and document whether and why the student or Sacramento State is primary beneficiary of the payment.

When the University and the student seem to derive equal benefit, units are strongly encouraged to designate the student as primary beneficiary.

Student as Primary Beneficiary

- Doctoral Dissertation Research Grants – The University System has determined that students are the primary beneficiaries of Doctoral Dissertation Research Grants such as the National Science Foundation's (NSF) Doctoral Dissertation Research Improvement Grants (DDRIG), even though the system also receives significant benefit from these grants.

- Research Traineeships – Research Training Grants funded by the National Institutes of Health (NIH), graduate research fellowships funded by the American Heart Association (AHA), and other research training grants are educational grants, so the student recipients are primary beneficiary of these payments. Trainees must fulfill the research and teaching requirements as detailed by the granters, but trainees do not perform services as student or system employees.

- Scholarship/Fellowship Funds – When the source of research or travel payments is a fund designated for scholarships or fellowships, the student is primary beneficiary.

Sacramento State as Primary Beneficiary

- Example A: A student is asked to travel to a conference held in San Francisco to present a paper on behalf of a the University department.

- Example B: A student travels to Germany to perform research for the University, which happens to be the same topic related to student B's dissertation. The University would perform research on this topic regardless of student B's dissertation topic.

- Example C: A student is asked to travel to New York City to represent the University in a Scholastic Bowl competition (in this example, the student is not required to be employed by the unit paying for the travel).

- Example D: A student submits a travel proposal in which the University’s business purpose is effectively described, receives departmental approval that requires a clearly stated deliverable upon the student's return, and the student presents that deliverable to the department's satisfaction.

- Example E: A student is asked to attend a conference or training that will enhance their knowledge and skills to effectively perform their university employment duties (e.g. student Orientation Leader).

Fellowships, scholarships, or grants paid directly to students for research experience programs are processed as fellowships as the student is the primary beneficiary. See Scholarships, Fellowships and Educational Assistance Grants for information on how to process. Example programs include:

- COAST Undergraduate Research

- CSUPERB

- SURE Awards

Payments made on behalf of students for travel, research, and related expenses who participate in these programs are processed through Concur as the University is primary beneficiary of travel and research related payments.

For fellowship payments to research experience/opportunity participants who are enrolled in the University during the semester in which payment is made, the program code should roll up to NACUBO function 1788 ("Fellowships").

How to Process

Student as Primary Beneficiary

U.S. Citizens, Permanent Residents, and Resident Aliens for tax purposes (Resident Aliens):

When paying U.S. Citizen and Resident Alien students for research and travel expenses that primarily benefit the student, these payments must be paid as a scholarship, fellowship or grant (see Scholarships, Fellowships and Educational Assistance Grants). The only exceptions to this rule are:

- Research expenses for human subject payments

- Wages paid to student workers

- Purchases of University property or equipment that retains functional value after the student's research is complete and remains in the University’s possession

Payments for these exceptions are submitted through Procurement & Contract Services or Payroll Services for student worker wages.

When paying U.S. Citizen and Resident Alien students for research and travel expenses that primarily benefit the student, units must be aware of the following requirements:

- When making research and travel payments from sponsored research funds, receipts documenting the full amount of the expenses must be forwarded to Sponsored Programs Administration (SPA) Post-Award or Accounts Payable & Travel sponsor funded travel and research expense payments may be delayed or reversed until all documents are received.

- Research and travel expenses are not generally part of the student's standard Cost of Attendance (COA) as established by Financial Aid (FA) in accordance with U.S. Department of Education (ED) guidelines; therefore, to minimize the risk of a travel or research scholarship or fellowship reducing the student's eligibility for other financial aid, the unit must notify FA that the scholarship or fellowship is for travel or research expenses that exceed COA, and provide FA with a description of the expenses being covered by the scholarship or fellowship.

- Research and travel scholarships or fellowships are disbursed to the student's university account and will be applied to any outstanding balance on the student's account unless the student or unit emails FA to request the scholarship or fellowship be refunded by direct deposited into the student's bank account to pay the student's travel or research expenses.

- Upon notifying students of scholarships and fellowships, units should inform the students that the scholarship or fellowship will be disbursed to the student's university account, that it may impact the student's other financial aid, and that the University will report it to the IRS on Form 1098-T. If the unit requests FA to refund any scholarships or fellowships to students, the unit must also inform those students that they may still owe an outstanding balance on their student account which must be paid by the due date to prevent a financial hold of registration and transcripts.

Nonresident Aliens – When paying Nonresident Alien students for research and travel expenses that primarily benefit the student, please reach out to IPGE or Accounting Services before letting the student know this may be an option. These items will take more time to complete.

Sacramento State as Primary Beneficiary

When paying students for research and travel expenses that primarily benefit the University, payments must be processed via Concur including a clear and comprehensive description with supporting documentation of the University business purpose and benefit. Research and travel payments that primarily benefit the University are not reportable to the IRS as taxable income. All University policies and procedures apply to these payments, including the requirement that payment or reimbursement requests be entered in Concur within 60 days of the date the expenditure was incurred, to avoid being reported to the IRS as taxable income. The unit is responsible for documenting why the University is primary beneficiary, and retaining this documentation for audit purposes.

The Student Service Center (SSC) manages the process and paperwork for all Financial Aid, including Scholarships. Though a scholarship may originate from a campus location, such as a college or program, scholarships may originate from an off-campus location as well. Regardless of who sponsors the scholarship, it must be processed to the Student Account through the SSC.

The SSC is reached at either (916) 278-1000, option 2, the first floor of Lassen Hall, or sacstatessc@csus.edu.

Sacramento State does not purchase tangible items for students. There are several reasons for this which include complicated tax and financial aid implications. Sacramento State does provide some items for students to use to complete coursework and program requirements. The Campus Bookstore provides items such as textbooks, laptops, hotspots, tablets, etc. through the Bookstore rental program. Bookstore rentals do have fees associated with rentals. The Department of Information Resources & Technology (IRT) may also be able to loan items to students for temporary use through their ‘Tech Equity’ program.

All tuition and fee waivers paid to students who are not Sacramento State employees are processed through the Student Service Center (SSC). The SSC is reached at either (916) 278-1000, option 2, the first floor of Lassen Hall, or sacstatessc@csus.edu.

For general questions about payments to students, please email accts-01@skymail.csus.edu

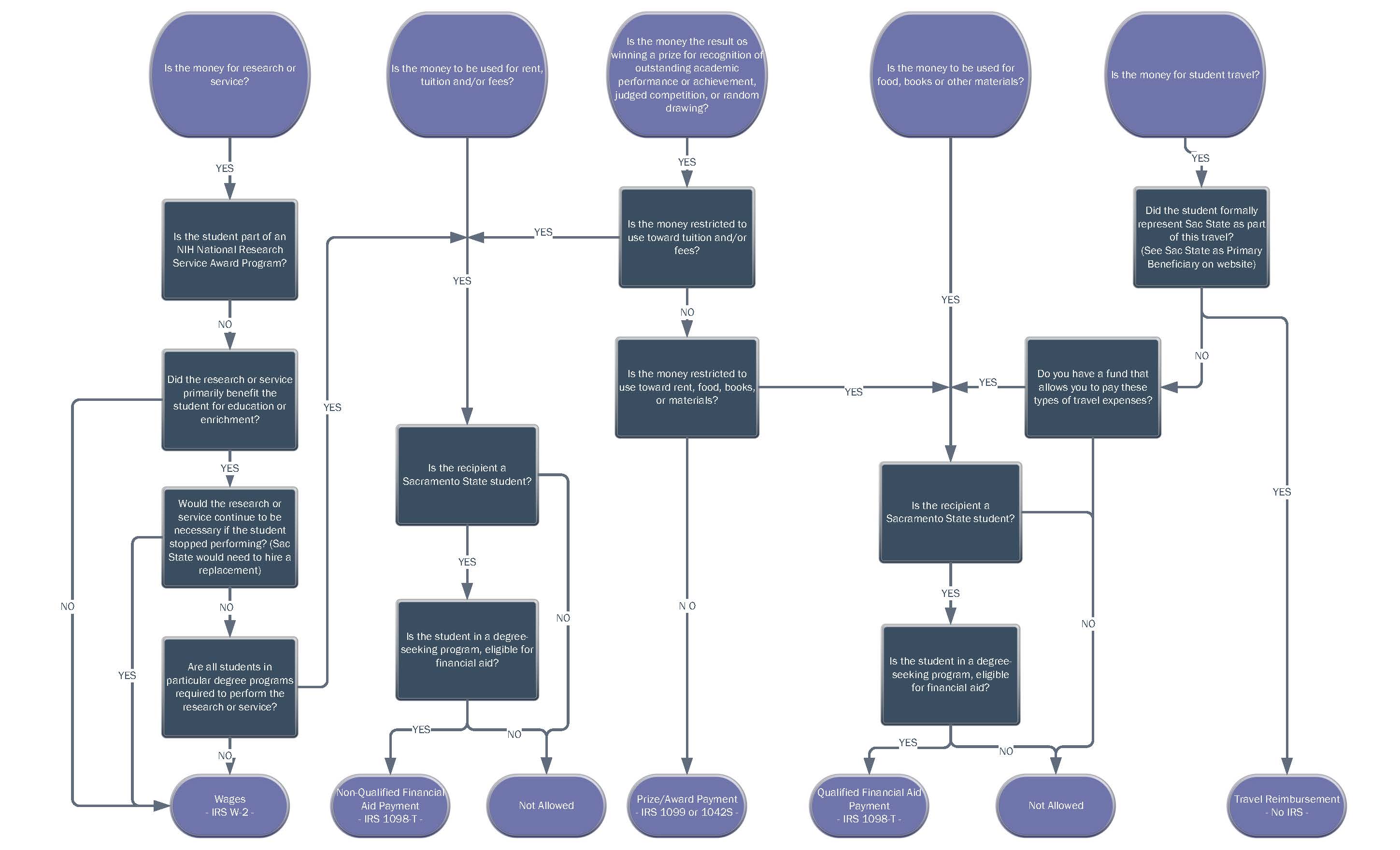

Decision Tree

Payments to Students Decision Tree